Companies that perform well on ESG are generally more trustworthy. This is the common thread in a loose terrain, where a variety of big players are proposing frameworks for businesses to assess the importance of Environmental, Social and Governance criteria.

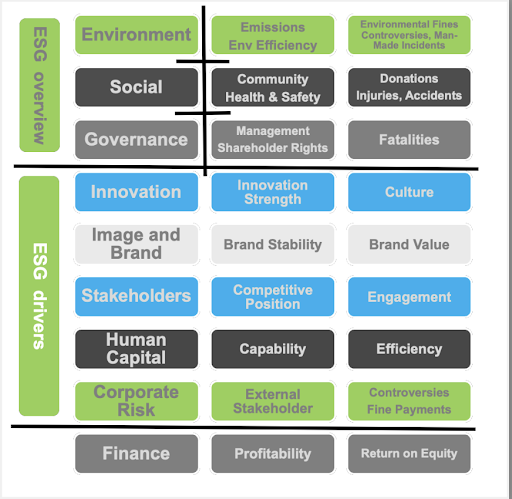

VUW has studied a range of these to prepare its Environmental, Social and Governance approach. (See graphic chart). This emerging necessity in business helps define our relationship to the world. It will serve VUW customers, workforce, partners, investors and communities.

ESG is still a loose terrain where common sense is gradually being translated into measurable criteria by a handful of rating organisations, such as Standard & Poor’s, Deloitte, MSCI, Sustainalytics, and RepRisk.

Environmental criteria consider a corporation as a shepherd of the environment, according to . Blaise Hope, writing for <a href=”https://sustainabilitymag.com/sustainability/a-beginners-guide-to-developing-your-companys-esg-strategy-environmental-

social-governance”>Sustainability on March 07, 2022.</a> Social criteria look at how the company maintains connections with its workforce, vendors, customers, and the communities in which it operates – what impact it has on people at each stage of its value or supply chain. Lastly, governance is concerned with the leadership of a corporation, executive remuneration, audits, internal controls, and shareholder rights.

Research from Harvard Business Review, working with Siemens on <a href=”https://hbr.org/sponsored/2021/10/the-6-elements-

you-need-to-build-effective-esg”>The 6 Elements You Need to Build Effective ESG</a>, identifies 6 critical factors as essential to the success of an ESG framework.

Decarbonisation

Ethics

Governance

Resource Efficiency

Equity

Employability

Siemens’ internal ESG targets are based upon this sustainability transformation platform, known as ‘DEGREE’.

For the time being, implementation is still up to a firm’s discretion, often under popular pressure. McKinsey Sustainability identifies three levels of corporate ambition in its <a href=”https://www.mckinsey.com/capabilities/sustainability/our-insights/how-

to-make-esg-real”>Make ESG Real</a> analysis. Minimum ‘do no harm’ practice, common practice and next-level practice, which fully integrates ESG into strategy and operations.

VUW’s positioning in the above concept map will place us in the upper category of ‘Next level practice’. We view ESG as a differentiator and core to overall strategy and we aim to increase social impact via innovation.

Legislation is being prepared in Europe and in the UK on disclosure and reporting, based on the <a href=”https://sdgs.un.org/#goal_section”>UN Sustainable Development Goals (SDGs)</a> and the IFRS Foundation’s <a href=”https://sasb.ifrs.org/standards/download/”>SASB® Standards</a> in relevant service industries such as Internet media

and software.

The UK Financial Conduct Authority’s <a href=”https://www.fca.org.uk/news/press-releases/sustainability-disclosure-and-

labelling-regime-confirmed-fca”>Sustainability Disclosure measures” of November 2023 are of interest. They tally with the EU

regulation that took effect in March 2021, forcing financial market actors to disclose information about their sustainability strategy

on their websites and elsewhere in the public eye. The EC concluded a <a href=”https://finance.ec.europa.eu/regulation-and-

supervision/consultations/finance-2023-sfdr-implementation_en“>consultation on implementation</a> in December 2023.

Clearly good ESG is a requirement for society, the planet and people’s working conditions. It is also better for the bottom line.

This optimistic assertion has recently been proved true in terms of disclosure, where studies show that good disclosure practises lead to better information flows and more reliable relationships between a firm and its investors.

An article on the fundamental effects of ESG disclosure, published via <a

href=”https://www.sciencedirect.com/science/article/abs/pii/S1042443122001275”>Science Direct</a>in the Journal of International Financial Markets, Institutions and Money Volume 81, November 2022, found that continually good ESG disclosure quality can grow ESG investment and increase a firms’ market value and ROA. Businesses that score well on ESG have better controls in practice and reduced downside risk, accelerating their growth.

Blaise Hope writing for <a href=”https://sustainabilitymag.com/sustainability/a-beginners-guide-to-developing-your-companys-esg-strategy-environmental-social-governance”>Sustainability on March 07, 2022.</a> concludes that good behaviour,

optimisation and improvement, must be evidenced with good reporting. The McKinsey analysis too considers it vital that ESG disclosure cover a company’s full operations.

At VUW, we wish to go further and consider how ESG can be used by insurers to make decisions about risk.

Recent studies suggest that ESG rating can be a useful metric for assessing risk in insurance. A study of ‘Crash risk and ESG disclosure’ in the Borsa Istanbul Review July 2022( <a href=”https://www.sciencedirect.com/science/article/pii/S2214845022000175”>Volume 22, Issue 4</a>) points out the moderating effects of ESG. Environmental, Social and Governance to offer greater control and greater insight. Companies implementing these practices gain a predictive power, and add information to perform effective risk analysis.

The author, Paulo Pereira da Silva, postulates that further information disclosure about ESG activities and risks mitigates crash risk by virtue of lower opacity and information asymmetry between managers and outside investors. Results from his examination of the ESG disclosure indicator suggest that all three dimensions (environmental, social and governance disclosure) weigh crash risk downwards. These relationships are under evaluation at VUW.ai.

ESG helps to improve a firms’ Tobin’s Q ratio (this ratio shows the relative under or over valuation of a business as it measures the market value of a company divided by its assets’ replacement cost) and more importantly their return on assets (ROA is a financial ratio measuring profitability in relation to total assets) and reduce downside risks.

We will be keeping track of best practice and the advance towards standardisation of ESG criteria in business operations.

Our longterm aim is to integrate sustainability indicators into the VUW decision engine, in keeping with our desire to help forge a better world.